Top 10 Ai Tools for Crypto Arbitrage Trading

If you’re even a little bit into crypto trading, you’ve probably heard the buzz: Ai Tools for Crypto Arbitrage Trading are everywhere in 2025, and they’re smarter, faster, and more accessible than ever before. But what exactly do these bots do? How do they work? And which ones should you actually trust with your money?

Let’s take a deep dive into the world of crypto arbitrage, explore the latest AI tools, and break down what makes them game-changers for both beginners and experienced traders.

What Is Crypto Arbitrage

First, let’s get on the same page. Crypto arbitrage is the practice of exploiting price differences for the same asset on different exchanges. For example, if Bitcoin is trading at $65,000 on Exchange A and $65,200 on Exchange B, you could buy on A, sell on B, and pocket the difference (minus fees).

Sounds simple, right? In reality, it’s a race against time. Price gaps close in seconds, and you need to factor in trading fees, withdrawal times, and even network congestion. That’s where AI comes in. Modern AI bots can:

- Scan dozens (or even hundreds) of exchanges and trading pairs in real time

- Analyze not just price, but also liquidity, fees, and slippage

- Learn from past trades and adapt strategies on the fly

- Execute trades automatically, 24/7, with microsecond precision

In short, AI bots do what no human can: they never sleep, never get tired, and never miss an opportunity.

Why 2025 Is Different: The Evolution of Arbitrage Bots

A few years ago, crypto arbitrage was mostly for coders and pros with custom scripts. Now, thanks to AI and machine learning, anyone can get started. The best bots don’t just follow static rules, they actually learn and improve over time, adjusting to market conditions and exchange behaviors.

For example, a modern AI bot might notice that Binance usually leads price moves, while another exchange lags by a few seconds.

The bot can then prioritize buying on the lagging exchange before the price catches up, maximizing profit. Some bots even track exchange reliability, typical withdrawal times, and fee structures, so they can avoid costly mistakes.

The Top AI Crypto Arbitrage Bots of 2025

Here is the leading platforms you should know about this year, based on performance, features, and user feedback.

1. Binance Arbitrage Bot

With a massive 17% market share, Binance isn’t just the world’s top exchange—it also offers one of the best built-in arbitrage bots.

The latest version uses a delta-neutral strategy for perpetual futures, automatically scanning for opportunities and executing trades using Binance’s deep liquidity. You can set your capital, choose your risk profile, and let the bot handle the rest. It also supports portfolio optimization, spot and futures grids, and more.

Why it’s great:

- Deep liquidity and fast execution

- Built-in risk management

- Supports multiple arbitrage strategies

2. Cryptohopper

Cryptohopper is a favorite for both beginners and pros. It connects with top exchanges like Binance, Coinbase, and Kraken, and its AI-driven bots can spot and act on arbitrage opportunities in real time. What sets Cryptohopper apart is its customization- use technical indicators, backtesting, trailing stop-loss, and even paper trading to refine your strategies before risking real money.

Why it’s great:

- User-friendly for all skill levels

- Advanced customization and backtesting

- Paper trading for safe experimentation

3. Bitsgap

Bitsgap is known for its all-in-one trading automation and powerful arbitrage engine. It constantly scans exchanges like Binance, Kraken, and Bitfinex, calculating potential profits after fees and suggesting the best trades. The interface is sleek and beginner-friendly, but there’s enough depth for advanced users too.

Why it’s great:

- Real-time scanning across many exchanges

- Profit calculations after fees

- No coding required

4. Pionex Arbitrage Bot

Pionex stands out for offering free, built-in AI-powered bots. You don’t need to pay extra to use their arbitrage tool, and it’s simple enough for total beginners. The 2025 update has improved automation and risk management, making it even easier to get started.

Why it’s great:

- Free to use

- Easy setup, no trading experience needed

- Advanced automation features

5. ArbitrageScanner.io

This platform is making headlines for its cross-exchange and cross-chain capabilities. ArbitrageScanner.io scans dozens of exchanges and even different blockchains (DeFi included) for price discrepancies, then automates both detection and execution.

It’s perfect for those who want to tap into the fast-growing world of cross-chain arbitrage.

Why it’s great:

- Cross-chain and DeFi support

- Real-time alerts and automation

- Integrates with many popular exchanges

6. HaasOnline

Aimed at advanced traders, HaasOnline lets you build custom, script-based strategies using live market data. Its AI modules are highly configurable, supporting both inter-exchange and intra-exchange arbitrage. The platform boasts ultra-low latency, which is crucial for grabbing fleeting opportunities.

Why it’s great:

- Deep customization for pros

- Backtesting and scripting tools

- Lightning-fast execution

7. 3Commas

3Commas is an all-in-one trading and portfolio management platform with AI-powered arbitrage bots. It’s especially popular for its automatic portfolio balancing and paper trading features, letting you test and optimize strategies risk-free before going live.

Why it’s great:

- Portfolio management + arbitrage

- Paper trading for testing

- Beginner-friendly interface

8. HyroTrader

HyroTrader is gaining traction among serious traders for its proprietary AI and trader-centric features. It’s designed to maximize arbitrage potential by learning from market patterns and adapting in real time.

Why it’s great:

- Adaptive AI that learns over time

- Focus on high-frequency and high-volume traders

- Integrates risk management tools

9. Coinrule

Coinrule is a popular automation platform that lets you create custom trading rules without any coding. Its AI-powered arbitrage features allow users to set up cross-exchange strategies, monitor price differences, and execute trades automatically. Coinrule stands out for its easy drag-and-drop interface and a large library of pre-built templates, making it accessible for beginners and advanced traders alike.

Why it’s great:

- No coding required- easy rule builder

- Supports multiple exchanges

- Pre-built strategies and templates

10. Quadency

Quadency offers an advanced trading automation suite with AI-driven arbitrage bots. It connects to major exchanges and provides unified portfolio management, real-time analytics, and customizable bot strategies. Quadency’s AI modules help identify and act on arbitrage opportunities efficiently, and its dashboard is praised for being intuitive and professional.

Why it’s great:

- Unified portfolio and multi-exchange management

- Advanced analytics and reporting

- Customizable AI-powered bots

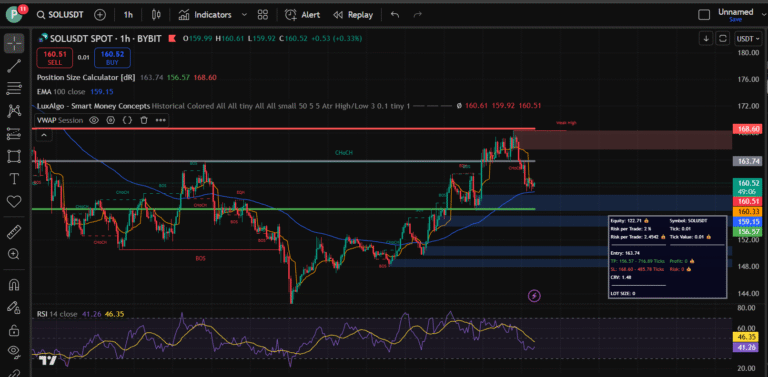

How AI-Powered Arbitrage Bots Actually Work

- Data Collection: The bot connects to multiple exchanges via API, pulling live price, volume, and liquidity data.

- Analysis: AI models analyze this data, looking for profitable price gaps while factoring in fees, slippage, and withdrawal times.

- Execution: When an opportunity is found, the bot automatically places buy and sell orders, often on multiple exchanges at once.

- Learning: Modern bots use machine learning to refine their tactics, learning which exchanges are fastest, which have the lowest fees, and which patterns repeat over time.

This means your bot isn’t just following a static set of rules, it’s getting smarter with every trade.

What’s New in 2025? (Emerging Trends)

- Cross-Chain Arbitrage: Bots now scan not just across exchanges, but across blockchains, tapping into DeFi and DEXs for even more opportunities.

- Real-Time Risk Management: AI bots now factor in exchange reliability, network congestion, and even regulatory risks before executing trades.

- User-Friendly Automation: With drag-and-drop interfaces and pre-built strategies, even total beginners can set up sophisticated bots in minutes.

- Community-Driven Strategies: Platforms like Cryptohopper and 3Commas let you use or share strategies built by other traders, so you can learn and profit together.

Practical Tips for Using AI Arbitrage Bots in 2025

- Start Small: Always test with small amounts or use paper trading to get comfortable.

- Watch the Fees: Arbitrage profits can disappear fast if you ignore trading and withdrawal fees.

- Mind the Speed: The faster your bot and the exchanges you use, the better your chances of capturing profits.

- Stay Updated: The best platforms update their AI engines regularly, make sure you’re using the latest version for the best results.

- Diversify: Don’t put all your funds on one exchange or in one strategy. Spread your risk.

Real-World Example: How a Modern AI Arbitrage Bot Works

Imagine you’re using Bitsgap. The bot is connected to Binance, Kraken, and Bitfinex. It notices Ethereum is trading at $3,500 on Binance and $3,520 on Kraken. In a split second, it buys ETH on Binance, transfers it to Kraken, and sells it for a $20 per coin profit (minus fees). If the bot does this dozens of times a day, those small profits add up, especially if you’re trading at scale.

Now, let’s say the market shifts and fees increase. The AI engine recognizes this, recalculates potential profits, and either adjusts the strategy or pauses trading until conditions improve. That’s the power of AI-driven adaptability.

Risks and What to Watch Out For

- Exchange Reliability: Not all exchanges are equally reliable or fast. AI bots help, but always check reviews and community feedback.

- Regulatory Changes: Laws can change quickly. Choose bots and exchanges that are compliant and transparent.

- Market Volatility: Sudden price swings can turn a profitable arbitrage into a loss if trades don’t execute instantly.

- Security: Use strong passwords, enable two-factor authentication, and never share your API keys.

Final Thoughts: Is AI Crypto Arbitrage Worth It in 2025?

If you’re willing to learn and stay updated, AI-powered arbitrage bots are one of the most exciting tools in crypto trading today.

They level the playing field, allowing everyday traders to compete with the pros. The tech is getting smarter, the tools are getting easier, and the opportunities are still out there for those who move fast and manage risk.

But remember: there’s no such thing as risk-free profit. Use these bots as part of a balanced trading strategy, never risk more than you can afford to lose, and always keep learning.

Have you tried any of these AI arbitrage tools? Got a favorite or a horror story? Drop a comment below—I’d love to hear your experiences and tips!

This post is for informational purposes only and isn’t financial advice. Always do your own research before investing or trading.

FAQs: AI Tools for Crypto Arbitrage Trading in 2025

1. What is crypto arbitrage trading?

Crypto arbitrage trading is the practice of buying a cryptocurrency at a lower price on one exchange and selling it at a higher price on another, profiting from the price difference. AI tools automate this process to identify and execute opportunities quickly.

2. How do AI arbitrage bots work?

AI arbitrage bots connect to multiple exchanges via APIs, scan for price differences in real time, analyze factors like fees and liquidity, and automatically execute buy/sell trades when profitable opportunities arise. Many bots also learn and adapt over time for better results.

3. Are AI arbitrage bots safe to use?

Reputable AI arbitrage bots are generally safe if you follow best practices: use strong passwords, enable two-factor authentication, never share your API keys, and only use trusted platforms. However, there are always risks, including exchange hacks or technical glitches.

4. Can I make guaranteed profits with crypto arbitrage bots?

No, profits are never guaranteed. While arbitrage reduces some risk compared to regular trading, factors like trading fees, withdrawal delays, slippage, and sudden market moves can impact your results. Always start small and monitor your bot’s performance closely.

5. Do I need coding skills to use these AI tools?

Most modern AI arbitrage platforms are designed for non-coders, offering user-friendly dashboards and drag-and-drop rule builders. Advanced users can often customize strategies with scripting, but it’s not required for basic use.

Contents

- 1 What Is Crypto Arbitrage

- 2 Why 2025 Is Different: The Evolution of Arbitrage Bots

- 3 The Top AI Crypto Arbitrage Bots of 2025

- 4 How AI-Powered Arbitrage Bots Actually Work

- 5 What’s New in 2025? (Emerging Trends)

- 6 Practical Tips for Using AI Arbitrage Bots in 2025

- 7 Real-World Example: How a Modern AI Arbitrage Bot Works

- 8 Risks and What to Watch Out For

- 9 Final Thoughts: Is AI Crypto Arbitrage Worth It in 2025?

- 10 FAQs: AI Tools for Crypto Arbitrage Trading in 2025