What Is Bitcoin, How It Works, and How to Invest in It

Hey, I am Mukesh, and today I am going to talking about (BTC), Bitcoin. What is bitcoin and how work and how to invest in it.

Not long ago, the idea of a “digital currency” sounded like something from science fiction. But in 2009, a mysterious developer (or group of developers) under the name Satoshi Nakamoto introduced Bitcoin to the world , and the world hasn’t been the same since.

Over the last decade and a half, Bitcoin has evolved from a niche internet experiment into a globally recognized form of money, investment, and technological innovation.

Whether you are curious about how it works or considering dipping your toes into the world of crypto investing, this guide will walk you through the basics in clear, with simple language.

What is Bitcoin?

At its core, Bitcoin is digital money. It is a form of currency that exists only online and allows people to send or receive payments without needing a middleman like a bank or payment processor.

Bitcoin can be used to buy goods and services, though it is more commonly seen today as a kind of digital gold, an asset people buy and hold in hopes it will increase in value.

A Simple Definition:

Bitcoin is a decentralized, peer-to-peer digital currency that uses cryptography to secure transactions and a public ledger called the blockchain to record them.

Still sounds a little abstract? Let’s unpack that.

Key Concepts Behind Bitcoin:

- Digital: You won’t find physical bitcoins like coins or bills. Everything happens on computers and the internet.

- Decentralized: Unlike traditional currencies (like the U.S. dollar), Bitcoin is not issued or controlled by a government or central bank. Instead, it operates on a network of computers spread across the globe.

- Peer-to-Peer: You can send Bitcoin directly to another person without needing PayPal, Visa, or a bank to process the transaction.

- Limited Supply: Only 21 million bitcoins will ever exist. That fixed supply makes Bitcoin immune to inflation in the way traditional currencies are.

Read: Best TradingView Indicators: Top Tools for Technical Analysis in 2025

Bitcoin Live Price

How Does Bitcoin Work?

Understanding how Bitcoin works does not require a computer science degree. Here is a breakdown in plain English.

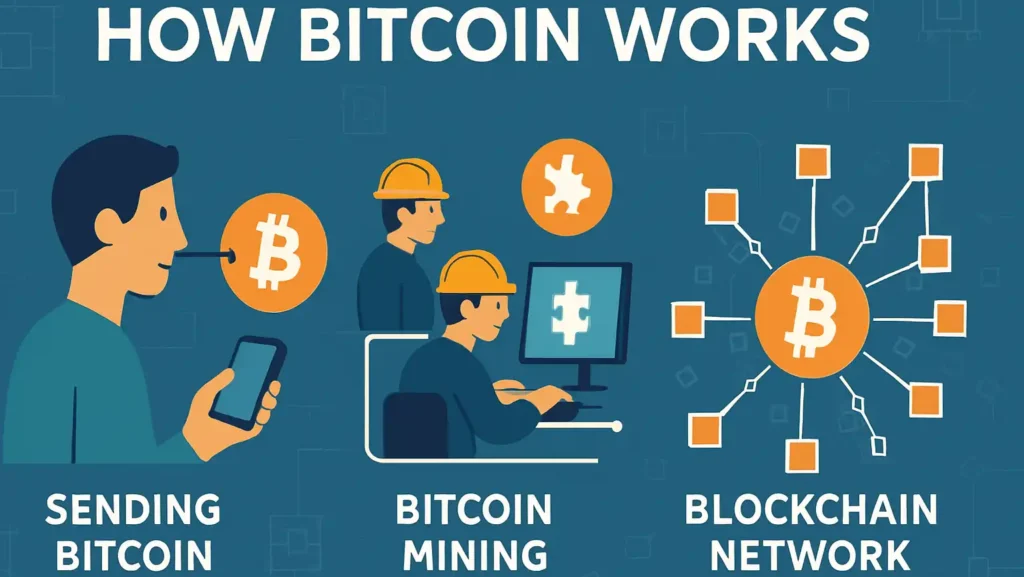

1. Blockchain: The Public Ledger

Imagine a digital notebook that keeps track of every Bitcoin transaction ever made. That notebook is called the blockchain. It is a public, transparent, and permanent record. Every time someone sends Bitcoin to someone else, that transaction is added to the blockchain for everyone to see.

But don’t worry, personal names or details are not shown. Transactions are tied to digital addresses, which look like long strings of letters and numbers.

2. Mining: Creating New Bitcoins and Processing Transactions

Bitcoin doesn’t come from a central authority like a government mint. Instead, new bitcoins are created through a process called “mining.”

Here’s how it works:

- Miners use powerful computers to solve complex math problems.

- When they solve a problem, they’re rewarded with newly minted bitcoins.

- At the same time, they help verify and record transactions on the blockchain.

This system keeps the network secure and functioning without the need for a centralized manager.

3. Wallets: Where You Store Your Bitcoin

If you buy Bitcoin, you will need a place to store it. That’s where digital wallets come in. Think of it like your crypto version of a bank account.

There are several types of wallets:

- Hot Wallets: Connected to the internet (apps, desktop programs)

- Cold Wallets: Offline storage (hardware wallets like Ledger or Trezor)

Your wallet has two keys:

- Public Key: Like your account number- others can see it and send you Bitcoin.

- Private Key: Like your password, you use it to send Bitcoin. If you lose it, you lose access to your coins. Period.

4. Transactions: Sending and Receiving Bitcoin

Sending Bitcoin is straightforward:

- Open your wallet.

- Enter the recipient’s public address.

- Choose how much to send.

- Confirm and sign the transaction with your private key.

The transaction gets sent to the network, verified by miners, and added to the blockchain.

Why Are People Investing in Bitcoin?

Bitcoin has made headlines for its dramatic price swings and stories of early adopters turning into millionaires. But it’s more than a get-rich-quick scheme. Here’s why many people consider Bitcoin a valid investment:

1. Scarcity (Digital Gold)

There will never be more than 21 million bitcoins. This scarcity mimics gold, a finite resource that holds value due to limited supply. Many see Bitcoin as “digital gold” and a hedge against inflation.

2. Decentralization

No government or central bank controls Bitcoin. For those skeptical of centralized monetary systems, Bitcoin offers an alternative store of value.

3. Speculation and Growth Potential

Bitcoin is volatile, sometimes wildly so. This makes it risky, but it also creates opportunities for high returns. Many investors buy Bitcoin hoping its value will rise over time.

4. Innovation and Tech Adoption

Bitcoin represents a broader technological shift toward decentralized systems. For some, investing in Bitcoin is like investing in the early days of the internet.

How to Invest in Bitcoin (Step-by-Step Guide)

Let’s break it down into actionable steps, so you can start investing confidently.

Step 1: Choose a Trusted Exchange

To buy Bitcoin, you’ll need to go through a cryptocurrency exchange – a platform that connects buyers and sellers.

Popular options include:

- Coinbase – Beginner-friendly, U.S.-based

- Binance – Global, low fees, more advanced tools

- Coindcx – For India

- Kraken – Strong security, good reputation

- Gemini – Regulated in the U.S., high compliance

- Cash App or PayPal – Easy but may have higher fees

Tip: Look for exchanges with solid security, a clean user interface, and good customer support.

Step 2: Verify Your Identity

Most platforms require you to complete KYC (Know Your Customer) checks:

- Submit a government-issued ID

- Take a selfie or record a video

- Provide basic personal details

It might feel invasive, but it is legally required to prevent fraud and money laundering.

Step 3: Fund Your Account

Once verified, you can deposit funds:

- Bank transfer

- Debit and credit card

- PayPal

Step 4: Buy Bitcoin

Now you’re ready to buy!

- Choose how much you want to invest.

- You can buy fractions of a bitcoin

- Place a market order or a limit order

Once purchased, your Bitcoin is stored in your exchange wallet, but read on before you leave it there.

Step 5: Store It Securely

While exchanges offer convenience, they’re also prime targets for hackers. If you’re planning to hold your Bitcoin long-term, move it to a more secure wallet.

Types of Wallets:

- Software Wallets: Exodus, Electrum, BlueWallet

- Hardware Wallets: Ledger Nano X, Trezor Model T

- Paper Wallets: A physical printout of your keys (less common today)

Pro Tip: Back up your wallet and never share your private keys with anyone. Ever.

Step 6: Monitor and Learn

Bitcoin’s price can be volatile. Use tools like:

- CoinMarketCap or CoinGecko – Track prices and trends

- TradingView – Charts and analysis

- Crypto Twitter and Reddit – Stay up to date, but verify sources

Bitcoin Investing Strategies

You don’t need to be a day trader to invest in Bitcoin. Here are a few common strategies:

1. HODLing (Buy and Hold)

A term born from a typo (hold) in a forum post, HODL refers to buying Bitcoin and holding it regardless of price swings. Many long-term investors believe Bitcoin will increase over years or decades.

2. Dollar-Cost Averaging (DCA)

Invest a fixed amount regularly. This helps you avoid the stress of trying to time the market and reduces the impact of volatility.

3. Active Trading

Buy low, sell high, easier said than done. Trading requires deep market knowledge, technical analysis, and emotional discipline.

4. Diversified Crypto Portfolio

Don’t put all your eggs in one basket. Some investors also hold Ethereum, Solana, or other altcoins alongside Bitcoin.

Risks and Cautions

Bitcoin is exciting, but it’s not risk-free. Here’s what to watch out for:

Volatility

Bitcoin’s price can swing wildly in a single day. Don’t invest money you can’t afford to lose.

Scams

Beware of fake wallets, phishing sites, and “investment opportunities” that promise guaranteed returns.

Regulation

Crypto laws vary by country and can change quickly. Stay informed and compliant.

Irreversible Transactions

Once you send Bitcoin, there is no undo button. Double-check addresses and amounts.

Common Questions About Bitcoin

Can I lose my Bitcoin?

Yes- especially if you lose your private key or get scammed. Always use secure wallets and backup strategies.

Is Bitcoin anonymous?

Not quite. Bitcoin is pseudonymous, your name isn’t on the blockchain, but your transactions are public and traceable.

Do I pay taxes on Bitcoin?

In most countries, yes. Bitcoin is considered property, and profits from selling or using it can be taxable. Consult a tax professional.

Can I use Bitcoin to buy stuff?

Some merchants accept it directly (like Overstock or certain travel sites). More commonly, people use Bitcoin debit cards to spend crypto like fiat.

Conclusion

Bitcoin is not just a passing trend, it is a revolution in how we think about money, value, and trust. That said, it’s still a young technology with growing pains and risks. Investing in Bitcoin can be rewarding, but it requires research, patience, and a level head.

If you are new, start small. Learn as you go. Don’t fall for hype, and never invest more than you can afford to lose.

And most importantly: Stay curious. Stay skeptical. Stay secure.