How to Buy Polkadot Easily: Full Guide

How to Buy Polkadot Easily: Hey crypto investors, here is complete guide of buy polkadot easily.

Polkadot (DOT) is not just another altcoin. It’s a groundbreaking blockchain protocol created by Dr. Gavin Wood, one of Ethereum’s co-founders.

Think of Polkadot like the “internet of blockchains” it allows multiple blockchains to interoperate, share data, and operate securely under one network.

Unlike Bitcoin and Ethereum, which each work as a single chain, Polkadot supports what are called parachains, smaller, specialized chains that plug into the main relay chain for security and consensus.

This unique approach solves two of blockchain’s biggest issues: scalability and interoperability. Polkadot can process many transactions on several chains in parallel, which speeds up the entire network. And because it lets different blockchains talk to each other, developers can build more versatile, interconnected applications.

In short, Polkadot is not just a cryptocurrency, it is an infrastructure. That is why investors, developers, and crypto enthusiasts are drawn to DOT.

Understanding the Basics of Cryptocurrency Investment

What You Need to Know Before Buying PolkaDOT

Before you dive into buying Polkadot, you need a quick crypto crash course. Investing in crypto isn’t like buying stocks or mutual funds, it is a different beast.

You’ll need a crypto wallet to store your DOT, and you will have to use exchanges (either centralized like Binance or decentralized like Uniswap) to actually make purchases.

Also, crypto prices are highly volatile. DOT could double in a week or drop just as fast. That’s why it’s essential to understand risk management, know your investment goals, and never invest more than you can afford to lose.

Make sure you also grasp how wallets, private keys, and public addresses work. Losing your private key means losing your DOT forever there’s no customer support hotline in decentralized finance.

Benefits and Risks of Buying Polkadot

Let’s break it down:

Benefits:

- High Growth Potential: With real-world use cases and a growing ecosystem, DOT could see serious gains.

- Staking Rewards: You can earn passive income by staking DOT.

- Interoperability: The ability to link chains makes Polkadot more useful long-term.

- Strong Development Team: Led by Gavin Wood, Polkadot has deep roots in blockchain innovation.

Risks:

- Volatility: Prices can swing wildly in hours.

- Regulatory Uncertainty: Governments around the world are still figuring out how to handle crypto.

- Tech Risks: Bugs in code or security flaws can spell disaster.

- Complexity: For beginners, the learning curve can be steep.

That said, with smart strategy and research, buying Polkadot can be a rewarding part of your crypto portfolio.

How To Buy Polkadot Easily

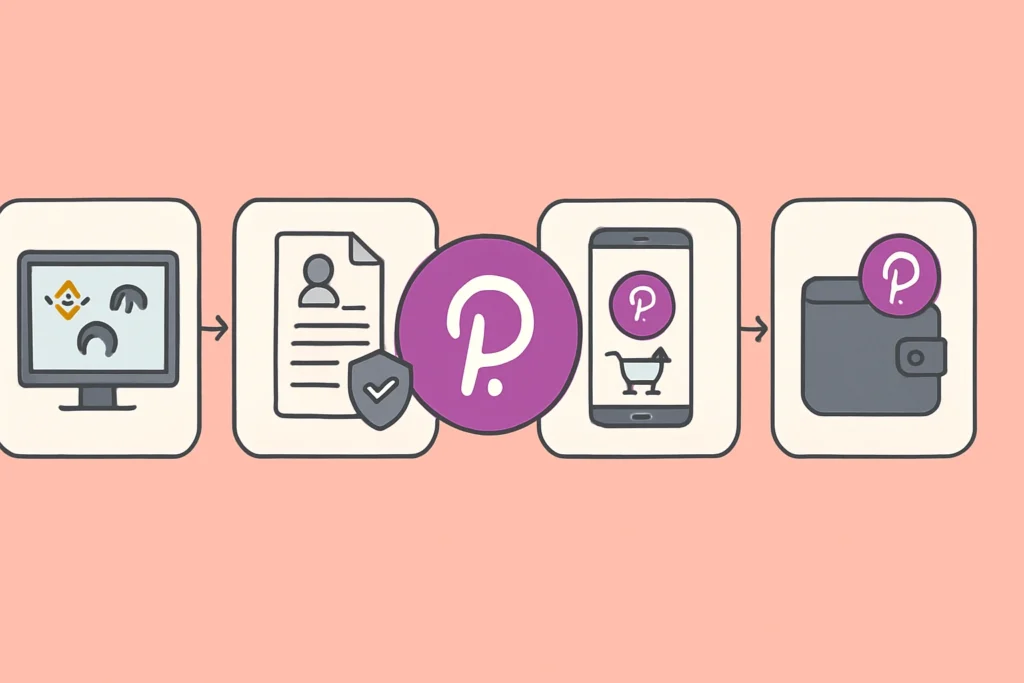

Step-by-Step Guide on How to Buy Polkadot Easily

Step 1: Choose a Crypto Exchange

This is your gateway to buying Polkadot. There are dozens of exchanges out there, but not all are created equal. When picking an exchange, prioritize:

- Reputation: Stick with established platforms like Binance, Coinbase, Kraken, or Bitfinex.

- Security Measures: Look for exchanges with two-factor authentication, cold storage, and a clean track record.

- DOT Availability: Make sure the exchange actually lists Polkadot (most top ones do).

- Payment Methods: Credit card? Bank transfer? Crypto deposit? Choose what suits you best.

- User Interface: For beginners, a clean and simple interface is essential.

Many exchanges even offer demo modes to practice trading without risking real money. If you’re completely new, try out a few platforms before committing. Remember, fees vary between exchanges from trading fees to withdrawal charges so factor those in too.

Step 2: Register and Verify Your Account

Once you’ve picked your exchange, it’s time to sign up. Here is how this typically works:

- Create an Account: Enter your email and create a strong password.

- Verify Your Email: Most platforms will send a verification link to your inbox.

- Complete KYC (Know Your Customer): You’ll need to upload identification documents like a passport or driver’s license, and sometimes a selfie for verification. This step is required by law in many countries for anti-money laundering compliance.

- Set Up 2FA: Always enable two-factor authentication it adds an extra layer of protection.

This process might feel tedious, but it’s there to keep you and your funds safe. Verification usually takes a few minutes to a few days depending on the exchange.

Step 3: Deposit Funds

You can’t buy Polkadot without loading up your exchange account with some funds. Here are your main options:

- Bank Transfer: Usually lower fees, but slower processing (1-5 business days).

- Credit/Debit Card: Faster, often instant, but comes with higher fees (1.5% to 5%).

- Crypto Deposit: If you already own Bitcoin or Ethereum, you can transfer it and trade it for DOT.

Each method has trade offs. For speed, go with cards. For affordability, bank transfers are best. After funding your account, you’re now ready to buy.

Step 4: Search and Buy Polkadot (DOT)

Now the exciting part, buying DOT. It’s usually this simple:

- Go to the “Markets” or “Buy Crypto” section.

- Search for “DOT” or “Polkadot.”

- Choose your trading pair: For example, DOT/USD or DOT/BTC.

- Decide how much you want to buy. You can either enter the amount of DOT or how much USD (or other currency) you want to spend.

- Choose order type:

- Market Order: Buys instantly at current market price.

- Limit Order: You set the price, your order executes only when DOT hits that price.

- Review and Confirm: Double-check the details before hitting Buy.

Congrats! You now own Polkadot. But don’t leave it on the exchange, let’s store it securely.

Storing Your DOT Safely After Purchase

Hardware Wallets vs Software Wallets

Once you’ve bought DOT, storing it safely should be your priority. Here’s a quick breakdown:

Hardware Wallets (Cold Storage):

- Devices like Ledger, Nano X or Trezor Model T.

- Completely offline = immune to online hacks.

- Best for large amounts and long-term holders.

Software Wallets (Hot Wallets):

- Apps like Trust Wallet, Exodus, or Atomic Wallet.

- Easy to use and good for daily trading or small amounts.

- Riskier since they’re online, vulnerable to malware and phishing.

Web Wallets (Exchange Wallets):

- These are wallets tied to your account on the exchange.

- Convenient, but you don’t own the private keys.

- Use only for short-term storage or active trading.

For serious investors, a hardware wallet is a no-brainer. If you are just dipping your toes in, a software wallet might be fine, just be sure to use a reputable one and back up your seed phrase.

Why Long-Term Holding Needs Better Security

HODLing (holding on for dear life) is a popular crypto strategy, and it works best when your investment is secure.

Here’s why stronger security matters for long-term holders:

- Exchanges Get Hacked: Billions have been lost to exchange hacks. Don’t risk it.

- You Own Your Crypto: Not your keys, not your coins. That’s the golden rule of crypto.

- Regulatory Issues: Governments can shut down exchanges. Your DOT could be frozen.

With long-term investments, security is not optional, it is essential. Whether it’s a $100 or $10,000 investment, treat it like gold and store it accordingly.

How to Sell or Trade Polkadot

When and How to Sell

Knowing how to sell DOT is as important as knowing when to buy. The process is essentially the reverse of buying:

- Go to your exchange’s “Sell” or “Trade” section.

- Choose DOT as the token to sell.

- Pick your desired trading pair (e.g., DOT/USD or DOT/BTC).

- Enter the amount you want to sell.

- Choose order type, market or limit.

- Review and confirm.

Timing your sale is key. Most investors sell during bull markets or when they hit a certain profit percentage (e.g., 2x or 3x gains). Others sell based on technical indicators or news events.

You might also want to sell just a portion of your holdings to take profits and keep the rest as a long-term play.

Exchanging DOT for Other Cryptocurrencies

If you’re looking to diversify instead of cashing out, consider trading DOT for other cryptos. Most exchanges offer DOT pairs with:

- Bitcoin (BTC)

- Ethereum (ETH)

- USD Coin (USDC)

- Solana (SOL)

To do this, follow these steps:

- Navigate to Markets or Trade.

- Search for your desired trading pair (e.g., DOT/ETH).

- Enter the amount of DOT you want to trade.

- Execute the trade.

This is a great way to rebalance your portfolio or take advantage of rising coins without exiting the crypto market entirely.

Best Platforms to Buy Polkadot in 2025

Centralized Exchanges (CEX)

Centralized exchanges like Binance, Coinbase, Kraken, and KuCoin make it incredibly easy to buy DOT with fiat currencies or other crypto. You just create an account, verify your identity, deposit money, and trade.

Pros:

- Easy to use

- High liquidity

- Support for fiat currencies (USD, EUR, etc.)

- Good customer support

Cons:

- KYC requirements

- You don’t control your private keys

If you’re a beginner, starting with a CEX is usually the best choice.

Decentralized Exchanges (DEX)

Want more control over your funds? Decentralized exchanges like Uniswap, PancakeSwap, or Polkadex allow peer to peer trading directly from your wallet.

Pros:

- No KYC

- Full control of your keys

- Often lower fees

Cons:

- Steeper learning curve

- Lower liquidity

- Risk of slippage

Advanced users often prefer DEXs for security and privacy reasons.

Mobile Apps vs Desktop Platforms

Whether you’re trading from your smartphone or PC, there’s a platform for you. Apps like Coinbase and Trust Wallet make mobile trading seamless. On desktop, platforms like Binance or Kraken offer advanced charting and analysis tools.

Pick what works best for your lifestyle. Just make sure it’s reputable, secure, and supports DOT.

Tips to Maximize Your Polkadot Investment

Best Times to Buy or Sell

Timing the market isn’t easy, but it can make a big difference in your returns. Here are some practical strategies to help you buy and sell Polkadot at the right moments:

- Buy During Market Dips: When the market is down, prices are often lower than DOT’s actual value. Think of it as buying on sale.

- Sell During Bull Runs: In a bull market, DOT’s price may skyrocket. Consider taking profits when it hits resistance levels or historic highs.

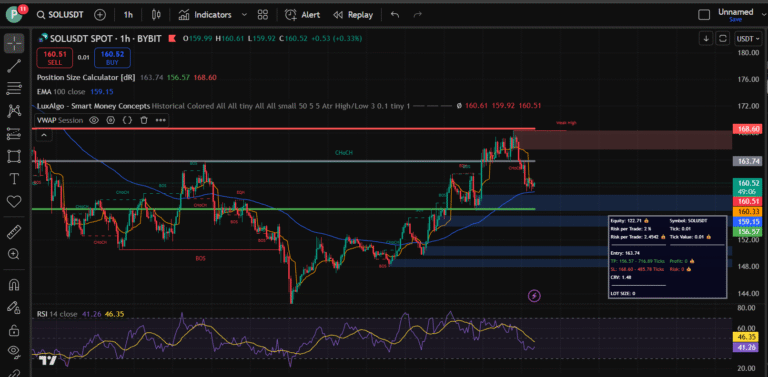

- Use Technical Analysis Tools: Tools like RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and volume indicators can help predict when a price change might occur.

- Set Alerts: Most platforms allow you to set price alerts, so you are notified when DOT hits your target.

- Stick to a Dollar-Cost Averaging (DCA) Strategy: Instead of guessing market tops and bottoms, invest a fixed amount regularly (example., $50 every week). This reduces emotional decisions and averages out your buying price over time.

Avoid trying to time the perfect peak or bottom, even pros get it wrong. The key is having a plan and sticking to it.

Avoiding Common Crypto Mistakes

Even seasoned investors make mistakes. Here are the most common pitfalls and how to avoid them:

- FOMO (Fear of Missing Out): Don’t buy just because a coin is trending. Do your own research.

- Panic Selling: Prices dip? That’s crypto. Don’t sell out of fear.

- Not Securing Your Wallet: If your private keys aren’t safe, your DOT isn’t safe.

- Over-Investing: Never put in more than you’re prepared to lose. Start small and scale up.

- Ignoring Fees: Trading fees, gas fees, and withdrawal charges add up. Always factor them in.

- Following Hype Over Fundamentals: Stick with projects (like Polkadot) that have long-term potential, not just temporary buzz.

Want to win in crypto? Think long-term, stay patient, and keep learning.

How to Protect Your Investment After Buying Polkadot

Crypto is a high-risk, high-reward space. Protecting your DOT is just as important as buying it.

Here’s how:

- Enable Two-Factor Authentication (2FA): Especially for exchange accounts.

- Use Strong Passwords: Avoid using the same password across platforms.

- Back Up Your Wallet: Keep copies of your seed phrase in multiple safe locations.

- Stay Updated: Follow crypto news and security best practices.

- Avoid Phishing: Don’t click unknown links or connect your wallet to shady websites.

By taking these precautions, you will drastically reduce the chances of losing your investment to scams or mistakes.

Legal and Tax Considerations When Buying Polkadot

Is Buying Polkadot Legal in Your Country?

The legality of crypto, including Polkadot, varies depending on where you live. Here’s a quick guide:

- United States: Legal to buy and sell DOT, but regulated by the SEC and IRS.

- Europe (EU): Mostly legal, with regulations tightening under the MiCA framework.

- Asia: Varies widely, Japan allows it, while China bans most crypto activities.

- Australia & Canada: Legal with KYC rules and tax obligations.

- India: Still not legal but can buy. KYC rules, 30% Tax, Buy with indian FIU registered exchange.

Read: Where to buy crypto in india

Always check local regulations. Some countries require registration with a licensed exchange, while others restrict certain crypto assets entirely.

If Polkadot is legal in your region, you are free to invest just make sure the platform you use complies with local laws.

Tax Responsibilities on Profits

Here’s the part most investors forget: taxes. In many countries, crypto gains are taxable. That means:

- If you sell DOT at a profit, you might owe capital gains tax.

- If you stake DOT and earn rewards, those rewards might be considered income.

- If you hold DOT long-term, you might qualify for lower tax rates.

Keep detailed records of your trades, profits, losses, and staking rewards. Tools like CoinTracker, Koinly, or Accointing can help automate this.

Pro tip? Consult a tax professional familiar with crypto in your jurisdiction. It’s worth it.

Future of Polkadot: Should You HODL or Flip?

DOT’s Roadmap

Polkadot has one of the most forward-thinking development roadmaps in the crypto space. The core focus areas for 2025 and beyond include:

- More Parachain Slot Auctions: These let projects secure spots on the network increasing DOT’s utility.

- Bridges to Other Networks: DOT aims to link with Ethereum, Bitcoin, and more, making it a true hub of interoperability.

- Decentralized Governance: Polkadot will continue shifting control to the community, making it more resilient.

- Scalability Upgrades: To stay competitive, Polkadot is constantly improving performance and transaction throughput.

This roadmap signals one thing: long-term value. DOT is more than hype it is being built for real-world use.

Market Predictions and Analyst Insights

Market analysts have mixed but generally optimistic views about Polkadot:

- Bullish Projections: Some see DOT reaching $50–$100 within the next few years, driven by parachain success and increasing adoption.

- Conservative Projections: Others predict steady growth tied to broader market trends, placing DOT in the $25–$40 range.

- Bearish Scenarios: In case of regulatory hurdles or low adoption, prices might stagnate or decline temporarily.

So, should you HODL or Flip?

- HODL if: You believe in the tech, want to stake DOT, or are investing for the long run.

- Flip if: You’re looking for short-term profits, market momentum plays, or portfolio rebalancing.

Most smart investors do a bit of both stake some, flip some.

Why Is Polkadot Popular Among Investors?

Why are so many investors jumping on the PolkaDOT? One word: potential. Polkadot has carved a unique position in the blockchain space, with real solutions to longstanding problems in crypto infrastructure.

It’s not just theory either dozens of projects are already building on Polkadot’s ecosystem.

The DOT token powers the network. It’s used for governance, staking (which secures the network), and bonding parachains.

This utility gives DOT actual value beyond speculation. Plus, since the network is designed to scale, it’s well-positioned to support widespread blockchain adoption in the future.

Combine this with major listings on top exchanges, strong developer activity, and an active community, and it’s easy to see why Polkadot continues to attract attention.

Conclusion

Buying Polkadot in 2025 is easier than ever and it could be one of the smartest crypto moves you make. With its cutting-edge technology, strong developer backing, and real-world use cases, DOT has carved out a powerful niche in the blockchain world.

But ease doesn’t mean risk-free. From securing your wallet to understanding taxes, every step requires careful thought. The key is to stay informed, use trusted platforms, protect your assets, and never let emotions drive your decisions.

Whether you’re in it for the long haul or looking for smart trades, Polkadot offers serious potential but only if you approach it with a solid plan. Happy investing, and welcome to the DOT universe!

I hope you must liked this info. on how to buy polkadot easily.

FAQs

Can I buy Polkadot with a credit card?

Yes! Most major exchanges like Binance, Coinbase, and Kraken allow you to buy DOT using a credit or debit card. Just be mindful of higher fees (often 2-5%) compared to other payment methods like bank transfers.

Is Polkadot better than Ethereum?

Not exactly better just different. Ethereum is a general-purpose smart contract platform. Polkadot focuses on connecting different blockchains together. Both have strong use cases, but Polkadot shines in interoperability and scalability.

How much Polkadot should a beginner buy?

Start small maybe $50 to $200 and scale up as you gain confidence. Remember, never invest money you can’t afford to lose. Use DCA (dollar-cost averaging) to spread out your risk over time.

Is Polkadot a good long-term investment?

Many experts believe it is, due to its unique technology, strong leadership, and growing ecosystem. However, crypto is volatile, so it’s important to research, diversify, and stay updated on market trends.

Can I earn interest on my DOT holdings?

Yes! You can stake DOT on platforms like Binance, Kraken, or directly through your wallet to earn passive income. Just make sure to understand lock-up periods and potential rewards before committing.

Contents

- 1 Understanding the Basics of Cryptocurrency Investment

- 2 How To Buy Polkadot Easily

- 3 Tips to Maximize Your Polkadot Investment

- 4 How to Protect Your Investment After Buying Polkadot

- 5 Legal and Tax Considerations When Buying Polkadot

- 6 Future of Polkadot: Should You HODL or Flip?

- 7 Why Is Polkadot Popular Among Investors?

- 8 Conclusion