Best Crypto Analysis Website in 2025: Top Tools You Need to Know

If you are diving into the world of cryptocurrency, having the right tools can make all the difference. Whether you’re a beginner tracking prices or a pro doing deep technical analysis, choosing the best crypto analysis website will help you make smarter decisions, faster.

In this guide, we’ll break down the top crypto analysis websites in 2025, based on features, accuracy, and ease of use.

Why You Need a Best Crypto Analysis Website

The crypto market moves fast. Prices can spike or crash within minutes. Having access to real-time data, clear charts, and reliable insights is key to avoiding losses and spotting opportunities early.

Here’s what a good crypto analysis site should offer:

- Live price tracking & charts

- Technical indicators (RSI, MACD, Fibonacci)

- On-chain data (whale movements, wallet activity)

- News and research

- Exchange listings and trading volume

Let’s explore the best platforms out there.

Top 5 Best Crypto Analysis Websites in 2025

- CoinMarketCap

- CoinGecko

- TradingView

- CryptoQuant

- Glassnode

If you want to simple analysis tool – Crypto Analyzer Tool

CoinMarketCap

CoinMarketCap has long been one of the most visited crypto websites in the world and for good reason. In 2025, it is still a powerhouse for both new and seasoned investors.

Known for its straightforward interface and comprehensive token listings, CoinMarketCap offers deep insights into the crypto ecosystem.

Features:

- Live price tracking for thousands of cryptocurrencies

- Market cap rankings with historical charts

- Watchlists and portfolio tools

- Tokenomics breakdowns including supply and burn data

- NFT and exchange ranking sections

- ICO calendar and event tracker

Strengths and Weaknesses:

Strengths:

- Huge database of tokens and exchanges

- Reliable historical data and charts

- Useful education section for beginners

- Widely trusted as a neutral source

Weaknesses:

- Limited technical analysis tools

- Overwhelming for beginners due to ad clutter

- Sometimes lags behind in breaking news

CoinMarketCap is the go to source for a bird’s eye view of the market, but advanced users may supplement it with other platforms for deeper analysis.

CoinGecko

CoinGecko is often seen as the perfect companion or alternative to CoinMarketCap. It goes beyond price tracking to include developer activity, community stats, and liquidity indicators giving a much more holistic view of each project.

Key Features:

- In depth coin stats and analytics

- Exchange volume and trust scores

- Community sentiment and developer activity

- DeFi, NFT, and derivative markets tracking

- API access for developers

- Geckonomics tools like yield farming and staking dashboards

Community Trust and Analytics Depth:

CoinGecko has earned a loyal following by being community-focused. It actively engages with its users and even releases annual crypto reports that analyze market trends, memes, and trading behavior.

Unlike CoinMarketCap, CoinGecko is known for maintaining objectivity and prioritizing transparency, which has helped it gain traction among serious investors and researchers.

The analytics depth, especially when it comes to DeFi protocols, liquidity pools, and staking options, makes CoinGecko a must-use in 2025 for both retail and institutional investors.

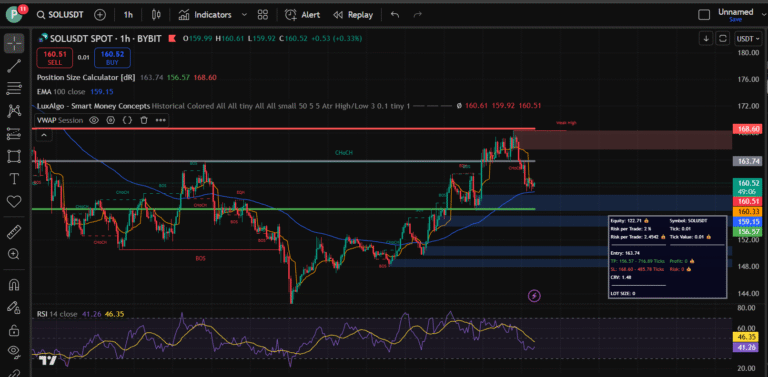

TradingView

TradingView is not just a crypto site, it’s a multi-asset charting platform that supports stocks, forex, commodities, and, yes, cryptocurrencies. But it’s how it handles crypto that makes it indispensable.

Tradingview is best crypto analysis website, this is my favourite tool ever.

Advanced Charting Tools and Customization:

What sets TradingView apart is its charting toolkit. You get access to:

- Dozens of indicators and drawing tools

- Custom scripting through Pine Script

- Social sentiment and analyst opinions

- Real-time trade setups shared by community members

- Strategy testing and backtesting tools

Whether you are day trading altcoins or swing trading Ethereum, TradingView offers the most advanced visual analysis available online. You can even integrate multiple assets into one chart, for instance, comparing BTC vs ETH vs SPY in one glance.

The cherry on top? TradingView integrates with popular exchanges like Binance and Kraken, allowing you to trade directly from the platform. And with their mobile app getting better every year, it’s a favorite among serious crypto traders.

CryptoQuant

CryptoQuant is an absolute gem for those who want a macro view of the market powered by on-chain data. This isn’t about simple price tracking, it is about understanding what’s happening under the hood of the blockchain.

On-Chain Metrics and Market Intelligence:

Here’s what CryptoQuant offers:

- Whale activity and large transaction alerts

- Miner inflow/outflow analysis

- Exchange reserve data

- Network value and hash rate monitoring

- Stablecoin flow tracking

- AI-generated market signals

CryptoQuant is beloved by analysts who want to predict trends before they appear on the charts. If you’re watching Bitcoin exchange reserves dropping fast, it might indicate a price pump is coming as supply shrinks.

Institutions especially rely on this kind of data for long-term trend forecasting. It’s a step up in sophistication, so while beginners might find the dashboard overwhelming, it’s one of the most powerful tools available.

Glassnode

If you want institutional-grade blockchain analytics, look no further than Glassnode. This platform is like the Bloomberg Terminal for crypto, it is that detailed.

Institutional-Grade Data Analytics:

Glassnode offers insights that go deep:

- Wallet behavior and UTXO analysis

- Net unrealized profits/losses (NUPL)

- SOPR and MVRV metrics

- Active address growth

- HODL wave charts and cycle analysis

These tools give you the power to see how “smart money” is behaving. Are whales accumulating or distributing? Are short-term holders panic selling while long-term holders stay calm? Glassnode tells you.

For traders who want contextual intelligence, not just numbers but meaning, Glassnode is indispensable. Its dashboards are sleek, and its tiered pricing model allows access to deeper metrics for those who are serious about crypto investing.

How to Choose the Right Crypto Analysis Platform

Matching Features with Investment Goals

Picking the right crypto analysis website isn’t a one-size-fits-all decision. It depends heavily on your investment goals, trading style, and knowledge level. Are you a casual HODLer, a DeFi yield farmer, or a full-time day trader? The answer will guide your choice.

If you are looking to analyze price movements and short-term trading opportunities, tools like TradingView and CryptoQuant offer extensive charting and on chain analysis. For long-term investment decisions, platforms like CoinGecko and Glassnode shine by providing deeper insights into token fundamentals, developer activity, and long-term market sentiment.

Ask yourself:

- Do I need real-time alerts or is daily analysis enough?

- Am I managing a portfolio of many altcoins or just tracking Bitcoin and Ethereum?

- Do I want educational resources or am I already confident with indicators and charts?

- Will I use this platform on mobile or just on desktop?

Some platforms also offer integration with wallets and exchanges, which is convenient for traders who prefer all-in-one dashboards. Others, like Glassnode, lean toward research and macro analytics, ideal for those who want to understand market cycles and investor psychology.

Ultimately, the best platform is the one that aligns with your daily habits, helps you make smarter decisions, and fits your budget.

Final Thoughts: Which Is the Best Crypto Analysis Website?

There’s no one-size-fits-all answer. The best crypto analysis website depends on what you need:

- Just want price updates? – CoinMarketCap or CoinGecko

- Love technical charts? – TradingView

- Curious about on-chain behavior? – Glassnode

Subscription Costs vs Free Access

While many platforms provide free access to basic features, the most valuable tools often come with a price tag. Here’s a breakdown of what you can expect:

| Platform | Free Version Available | Premium Features Cost | Best For |

|---|---|---|---|

| CoinMarketCap | Yes | $0 | Beginners, general tracking |

| CoinGecko | Yes | $0 | Fundamentals, community stats |

| TradingView | Yes | $14.95 – $59.95/month | Charting, TA pros |

| CryptoQuant | Limited Free Access | $29 – $799/month | On-chain data, institutions |

| Glassnode | Limited Free Access | $29 – $799/month | In-depth cycle analysis |

While platforms like CoinGecko and CoinMarketCap offer plenty of free insights, the real alpha lies in paid tools, custom indicators, in-depth metrics, and early alerts. If you’re serious about trading or investing, consider it an investment in your performance.

However, if you are just starting out, don’t feel pressured to go premium right away. Master the basics with free tools, then level up when you’re confident those premium features will actually deliver ROI.

Beginner vs Expert User Considerations

For beginners, the crypto space can feel like drinking from a firehose, too much data, too fast. That’s why simplicity and educational support are key. Sites like CoinMarketCap and CoinGecko are ideal starting points. They explain technical terms, offer curated lists, and include tutorials.

Here’s what to look for as a beginner:

- Simple dashboards with minimal clutter

- Definitions for crypto terms and metrics

- One-click portfolio creation and tracking

- Mobile-friendly apps with alerts

- Community ratings and reviews

On the other hand, expert users demand precision, speed, and depth. Platforms like TradingView, Glassnode, and CryptoQuant are designed for this crowd. They offer custom scripting, real-time indicators, and downloadable data sets.

Advanced users often juggle multiple platforms. A day trader may run TradingView side-by-side with CryptoQuant to time entries based on both price action and whale behavior. A long-term investor may watch NUPL signals on Glassnode while scanning CoinGecko for new tokenomics.

The best part? Most top platforms scale with you. You can start on free tiers and unlock deeper layers as your experience grows.

Ready to Analyze Smarter?

Explore these platforms, use best crypto analysis website and see what works for your trading or investing style. In the fast-paced world of crypto, the right tools give you the edge.

Which one is your favorite? Let us know in the comments!

Read also