How to Trust Your Trading System: Strategy for Long-Term Success

How to Trust Your Trading System

When you sit down to trade, especially in the fast-moving world of crypto, do you ever feel that sinking thought: “Maybe my system isn’t working anymore”? Or perhaps you’re constantly searching for a perfect trading system – one that always wins and never fails.

If yes, you are not alone. And more importantly, you’re not wrong to feel that way.

But here’s something your experienced trader friend would tell you over a cup of coffee:

“There is no perfect system. There is only a system you learn to understand, trust, and grow with.”

Let’s dive deep into what it really takes to trust your trading system and stop jumping from one strategy to another every time you hit a rough patch.

1. Stop Chasing Perfection

You might have started trading believing that there is a magic formula out there. A setup that will never lose. And when that doesn’t happen, the natural reaction is to doubt the system and try something new.

But let me break a myth for you- Every trading system fails sometimes. Even the most successful traders have losing streaks.

What separates them is this: they don’t quit on their system after a few losses. They stay. They analyze. They adapt.

2. Trust Comes From Understanding

You can only trust what you deeply understand.

Think about your best friend. You trust them not because they are perfect, but because you know them. You know how they react under pressure, what their strengths are, and where they need support.

Your trading system is the same. It has strengths. It has weaknesses. The better you know it, the more you can rely on it.

Ask yourself:

- When does your system perform best?

- When does it struggle?

- Have you tested it across different market conditions?

If you haven’t done this, your trust will always be fragile.

3. Data is the Bridge Between Doubt and Confidence

This part is crucial.

Every time you switch systems without gathering and analyzing data, you’re acting on emotion, not logic.

Start recording your trades. All of them. The winners, the losers, the break-evens. Note:

- The setup you used

- The market context

- Your entry and exit

- The result

Then review the data after 50 or 100 trades. You might find something surprising: “My system works only 40% of the time, but the winning trades are twice as big as the losses.“

Suddenly, your trust won’t depend on how you’re feeling that day. It will be built on proof.

Read:- Where to Buy Crypto in India: Legal, Safe

4. Use a Trading Journal

Most traders think journaling is optional. But if you are serious about building trust in your system, it’s non-negotiable.

With a trading journal, you:

- Spot recurring mistakes

- Identify patterns

- Track emotions that affect your trades

- Pinpoint areas for improvement

We’ve built a simple, clean Trading Journal Tool just for this purpose.

✍️ Start Journaling Your Trades and get clarity like never before.

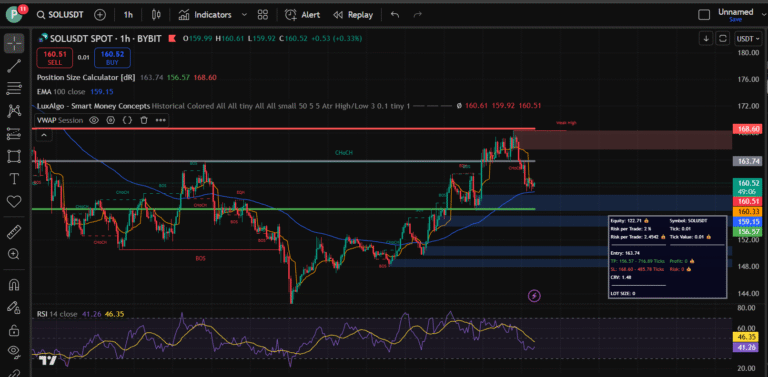

5. Backtesting: The Trust Builder

Before you risk real money, why not test your system over past data? That is exactly what backtesting is.

With proper backtesting:

- You see how your system performs in various market scenarios

- You understand drawdowns before they happen

- You build confidence in execution

Try our free Strategy Backtester.

✅ Test Your Strategy Now and gain real evidence your mind can trust.

6. Losses Aren’t a Sign to Quit

Every loss doesn’t mean your system is broken. Sometimes, it just means the market conditions weren’t ideal.

A trusted system is like a relationship. You don’t walk away after a fight. You talk, you analyze, and you improve.

Review the trade:

- Was it a valid setup?

- Did you follow your rules?

- Was it a market issue or a system issue?

Sometimes a small tweak in entry timing or stop-loss placement is all it takes. But you can only spot that with journaling and data.

7. The Psychology of Sticking With It

Let’s get real. Even if you know your system works, and even if you have the data, you’ll still feel fear when you lose money.

That’s human. That’s normal.

But here’s the shift: Trust isn not a feeling. Trust is a decision.

And that decision is backed by discipline.

You need to keep showing up, following your rules, and executing your plan. Again and again. Even when it sucks.

Your edge is not just your system. It’s your ability to stick with it.

8. Even Pros Use Simple Systems

You might be shocked to know that many professional traders use basic strategies like:

- Moving average crossovers

- Support and resistance zones

- Breakout confirmations

What makes them profitable? Unshakable discipline.

They’ve tested their strategy. They have journaled their trades. They have seen the drawdowns and kept going. That is what separates them.

9. Trust Grows With Time, Not Tricks

There’s no hack. No shortcut.

You trust your system because you have tested it, recorded it, improved it, and stuck with it. And slowly, your fear fades.

You stop questioning every move. You stop doubting every red candle. You breathe. You trade. You follow your rules.

And over time, something magical happens:

You become consistent.

10- Your System is a Relationship

Not a tool. Not a machine.

A relationship.

You have to nurture it, understand it, stay loyal to it, and keep refining it.

Because trading isn’t about finding the best system.

It’s about building trust in your system.

So ask yourself today:

- Do I really understand my system?

- Have I backtested it?

- Am I recording my trades?

- Have I improved it logically?

- Do I stick to it even when I lose?

If you can say yes to these questions – congratulations.

You’re not just trading.

You’re growing.

Tools to Help You Build Trust

If this resonated with you, don’t leave empty-handed. Start building trust TODAY with these tools:

- ✅ Crypto Strategy Backtester – Test your system risk-free

- ✍️ Trading Journal – Understand your patterns, improve execution

Let the market do what it does. You just keep your side of the discipline.

Final Words – Conclusion

Trusting your trading system is not a one-time decision. It is a journey.

A journey of study, reflection, failure, learning, and courage.

And if you ever feel alone in this journey, remember: Every pro trader has walked the same path.

They didn’t win because they avoided losses.

They won because they understood, trusted, and stuck with a system – even when it was hard.

So don’t search for the perfect system.

Build a real relationship with the one you believe in.And let that trust be your edge in the chaos of the market.

Let’s grow together. Let’s trade with confidence.

See you at the next level.

Thanks..

Read: Best RSI Settings for Day Trading: A Comprehensive Guide

Contents

- 1 How to Trust Your Trading System

- 1.1 1. Stop Chasing Perfection

- 1.2 2. Trust Comes From Understanding

- 1.3 3. Data is the Bridge Between Doubt and Confidence

- 1.4 4. Use a Trading Journal

- 1.5 5. Backtesting: The Trust Builder

- 1.6 6. Losses Aren’t a Sign to Quit

- 1.7 7. The Psychology of Sticking With It

- 1.8 8. Even Pros Use Simple Systems

- 1.9 9. Trust Grows With Time, Not Tricks

- 1.10 10- Your System is a Relationship

- 2 Tools to Help You Build Trust

- 3 Final Words – Conclusion