Real Trading Discipline: Why 4AM Routines Won’t Make You Profitable

Real Trading Discipline

This morning when I opened Reddit, I came across a post by a fellow trader. He was talking about how waking up at 4AM doesn’t actually increase your profits, that real trading discipline is something entirely different.

So in this blog, I tried to break it down in simple and clear language: what real discipline in trading actually means.

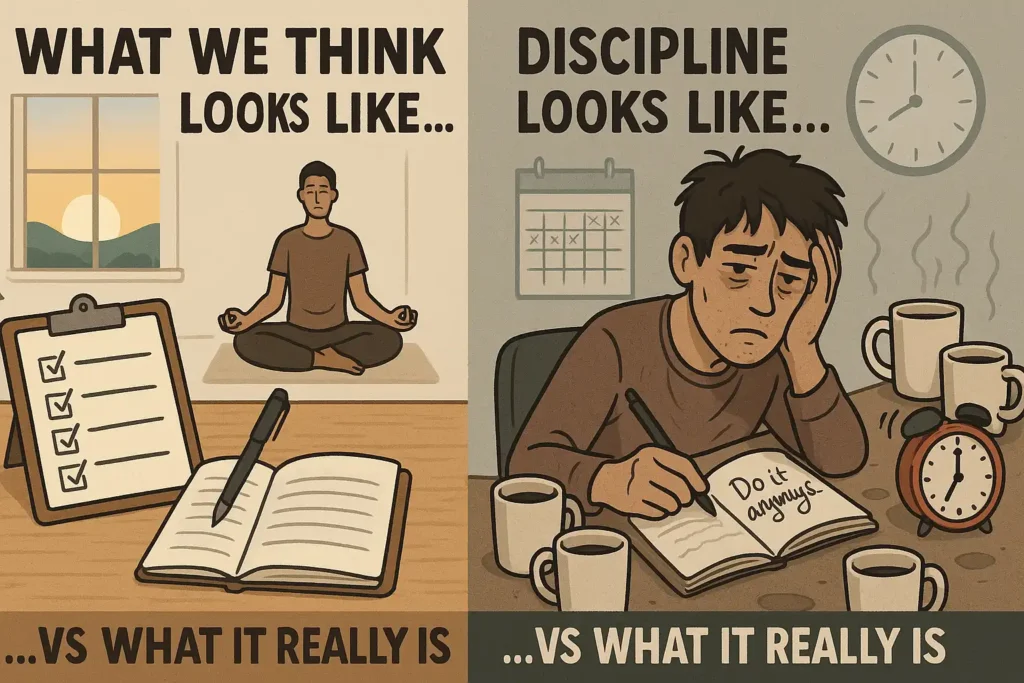

The Illusion of Discipline

In trading communities, the word discipline gets thrown around constantly. Everyone talks about it like it is the secret to success: wake up at 4AM, take cold showers, read 10 pages a day, meditate, and track every habit on a spreadsheet.

But here’s the truth nobody talks about, doing all that doesn’t make you a disciplined trader.

Recently, a Reddit post by a user named Angel gained a lot of traction. It called out this exact thing: how traders often confuse looking disciplined with actually being disciplined. And honestly, it hit home for a lot of people.

Because the reality is, if you are still taking impulsive trades at 9:15AM just because the setup “feels right,” all that cold plunging and journaling doesn’t mean anything.

What We Think Discipline Looks Like

Most people imagine discipline as a checklist. Early mornings, intense routines, no days off. It looks clean, organized, focused. And yeah those habits can be helpful. Waking up early can give you a head start. Journaling can help you reflect. Meditation can help your mindset.

But none of that matters if you abandon your trading plan the moment your emotions take over.

That’s not discipline. That’s performance. You’re trying to feel productive instead of actually being consistent.

What Discipline Actually Looks Like

Real discipline is boring. It’s quiet. And honestly, it’s not that fun.

It looks like:

- Skipping a trade that looks “okay” but doesn’t match your exact setup.

- Sitting on your hands through an entire morning because the market is not moving the way you need it to.

- Taking a small $40 gain and walking away, even when part of you wants to keep going and “just try for a little more.”

- Writing down the same mistake you made yesterday again and actually making sure you don’t repeat it tomorrow.

Nobody claps for that. There’s no dopamine rush in doing the right thing when it doesn’t feel exciting. But that’s the stuff that builds long-term consistency.

The Dopamine Trap

Let’s be honest a lot of us don’t trade for the money. At least, not entirely.

We trade for the feeling. The adrenaline. The possibility. That little rush when a candle spikes in our direction, or the temptation of “just one more trade” even after a green day.

That’s where things go wrong.

This is what Angel called out perfectly in reddit- chasing dopamine is the enemy of discipline. You might get away with it a few times. You might even make money by breaking your own rules. But eventually, that behavior catches up.

The market doesn’t punish you immediately and that’s the trap. It tricks you into thinking bad habits are working, until suddenly they don’t.

Most Traders Can’t Handle Boredom

Here’s the part that stings a little: most traders aren’t struggling because they don’t know enough. They’re struggling because they can’t sit still.

When the market is slow, or choppy, or not giving clean setups that’s when discipline really matters. But instead, most people force trades. They need to be in something. They hate sitting idle.

And part of the reason for that? Social media.

We’re constantly bombarded with other people’s PnL screenshots, “grind mode” montages, and stories of how someone flipped $100 into $10,000. It creates this pressure that if you’re not in a trade, you’re missing out. If you’re not constantly improving, you’re falling behind.

That mindset is dangerous. It turns trading into a performance instead of a process.

Building Real Discipline: A Different Approach

So if real discipline isn’t about early mornings and cold plunges, what is it about?

It’s about building habits that actually support your trading. Not your ego. Not your Instagram story. Your trading.

Here are a few key shifts to focus on:

1. Know Your Edge and Stick to It

Define your setup. Be specific. What time of day do you trade best? What patterns work for you? What market conditions suit your strategy?

If you don’t have an edge, you’re gambling. And if you have one, but ignore it you’re sabotaging yourself.

2. Respect Your Daily Goal

If your plan was to make $100 and walk away, do that. Don’t chase more. Don’t let greed override your system.

It’s better to end the day green and a little bored than red and full of regret.

3. Accept That Some Days Are Just Dead

Some days, the market won’t give you anything. And that’s okay. The job isn’t to always make money. The job is to protect your capital and only act when your edge appears.

Train yourself to be okay with doing nothing. That is part of the game.

4. Journal Honestly

Don’t just track your wins and losses. Write about your emotions. What did you feel during that losing trade? Why did you break your rule? What triggered the impulse?

Then, and this is key, actually do something with that information the next day.

5. Study Your Bad Days

Everyone loves reviewing their green trades. But your red days? That’s where the real learning happens.

Study those closely. Not just what went wrong technically, but what went wrong behaviorally. Where did your discipline slip? What could you have done differently?

The Stuff That Pays (Even When It Doesn’t Feel Like It)

Discipline isn’t exciting. It’s not sexy. And it definitely doesn’t get you likes or applause.

But it works.

It builds consistency. It protects your capital. It lowers your stress. It turns trading from chaos into something stable.

Most people aren’t consistent because they don’t stick to their rules. And they don’t stick to their rules because they’re chasing feelings, not results.

So next time you see someone post their 4AM routine or their 6-monitor setup, just remember none of that matters if they’re still breaking their own rules 10 minutes into the trading session.

Final Thoughts

The trading world is filled with noise. Courses, content, clickbait, all trying to sell you the idea that success comes from intensity and motivation.

But real success? That comes from doing the boring stuff, every day, even when it sucks, even when nobody notices, even when you don’t feel like it.

So if you’re trying to become more consistent, forget the hype.

Ask yourself one simple question: Did I follow my system today, even when I didn’t want to?

If the answer is yes, you’re already way ahead of the crowd.

Here is some trading tools available you can check and improve your strategy and trading discipline also. Trading Tools.

Contents

- 1 Real Trading Discipline

- 2 Final Thoughts